A third of UK employers (34%) think that high employee stress levels are a direct consequence of their staff not having enough savings, including pensions, according to the latest Close Brothers Business Barometer.

A further 25% have seen employee health issues arise due to money worries, and 14% have seen higher absenteeism for the same reason. Only 17% of employers think that poor financial management by their staff has no impact on their business.

Despite this, nearly half of UK businesses (47%) neither offer financial education to staff nor plan to do so. A mere one in five businesses provide financial education to their workforce, and of those, 14% describe the service they offer as ‘limited’.

The most common financial education programmes are delivered via individual face-to-face meetings, with 37% choosing this method. 35% include group face-to-face conferences and workshops, while 25% use web-based seminars. A further 26% include email education in their programme, and 23% use an online platform. More unusual methods include post (9%) and texts (4%).

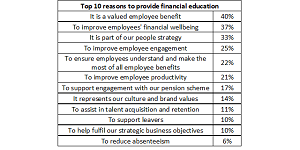

Those who offer financial education do so for a variety of reasons. Employers see it as a valued employee benefit (40%), as well as a way to improve employees’ financial wellbeing (37%), and because it’s part of the businesses’ people strategy (33%).

Things may be set to change. 36% of employers do not currently offer financial education, but plan to start doing so in the next three years. SMEs with 11-60 employees are most likely to fall into this bracket, with 50% claiming to have the introduction of a financial education programme in their plans for the next three years.

Jeanette Makings, Head of Financial Education at Close Brothers, commented: “It’s clear that employees are not saving enough, nor are they saving in the most effective way. This is true for both short and longer term financial planning including pensions. Employers are perfectly placed to help their workforce become more confident and competent in financial decision making, in turn having a direct impact on their financial, physical, and emotional wellbeing. Those who receive financial education find it useful in guiding their immediate, medium, and long-term saving decisions. This then frees up employees at work to be happier, healthier, and more productive.

“As such, having a comprehensive financial education strategy is a win-win for employers. It could even go some way towards solving the UK’s productivity puzzle.”